Overview

In March 2011, at the end of a month-long jury trial in Marin County Superior Court, Commins & Knudsen obtained a verdict and judgment against Nationwide Insurance for $686,178 in compensatory damages and $1,200,000 in punitive damages.

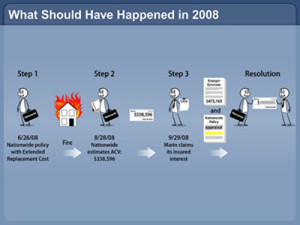

Marin Mortgage Bankers Corporation (Marin Mortgage) was both a Defendant and a Cross-Complainant in this action that arose from an August 2008 house fire. Roy Smally, Jr. and his wife, Vivi Mitchell, ran a home for delinquent youth in Vallejo. They borrowed money from Marin Mortgage and attempted to obtain an insurance policy from Nationwide Insurance. Marin Mortgage alleged that after the fire, Nationwide Insurance declared the policy cancelled, denied coverages, refused acknowledged coverages and used improper appraisal methods to distort benefits under the policy. Marin Mortgage also alleged that before the fire Nationwide Insurance had failed to notify it that the policy was pending cancellation, and then failed to notify it that the policy had been cancelled until after the fire.

In April 2014 the Court of Appeal affirmed almost the entire award to Marin Mortgage, leaving intact compensatory and punitive damages, as well as Brandt fees, or $1,838,596 plus costs and interest.

.