Overview

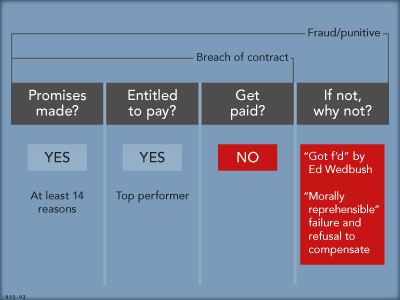

Our client joined Wedbush Securities in its Institutional Equities Division in 2005. She quickly captured the attention of her superiors, and in 2007 she began training to take over for her supervisor as the manager of the division. Our client alleged that Wedbush had promised certain levels of compensation in fiscal years 2007-2011. She performed her management duties beyond expectations, but Wedbush consistently underpaid her during her four years in management. Finally, because she could no longer work without being paid what she had been promised, she was forced to resign in June 2011.

After Wedbush sued our client, claiming that it had loaned her $85,000, she counter-claimed seeking her unpaid compensation.

Commins & Knudsen showed that its client was but the latest example of a larger problem at Wedbush. Despite multiple resignations and claims for unpaid compensation by senior executives dating back to at least 2008, the alarm and departure of independent Board members, sworn testimony by its former Board Chairman that he had ethical concerns about the practice, a multi-million dollar FINRA award against the company in Kelleher v. Wedbush, and a FINRA panel’s characterization of the practice as a “morally reprehensible failure and refusal to compensate,” Ed Wedbush testified that he had not even bothered to read the criticism, and had done nothing to alter company policies at the heart of the dispute.